About us

We’re one of the largest owners and operators of renewable and firming energy generation assets in the Australian market.

Our vision is to contribute to a cleaner energy future whilst caring for our community and environment, and supporting local economies through job creation, investment, and infrastructure development.

RATCH Australia Corporation (RAC) was founded in 2011 and currently owns and manages 11 energy generation assets around Australia. All of these assets are renewable energy assets or gas-fired power stations that provide stability to the renewable energy market.

The RATCH Group acquired Nexif Energy in December 2022 and integrated its Australian entities (RAC) in December 2023. The relevant assets include Snapper Point Power Station and Lincoln Gap Wind Farm 1 and 2, plus Lincoln Gap 3 along with some other development opportunities. These assets and development projects are managed by a separate team under separate Boards, with support from the RAC team.

Our vision

Continue to grow as a leading independent power producer in Australia whilst caring for our community and the environment.

Our mission

Invest in, develop and own a diversified portfolio of high quality power assets in Australia.

Our values

Professional

Be entrepreneurial and commit to integrity

Innovation

Boost agility and encourage innovation

Teamwork

Excel at synergy and collaboration,

strengthen partnerships

Our Origins

RATCH Group's roots can be traced back to the Thai government's decision to open up its electricity sector to private investment in the late 1990s. In 1999, the Thai Cabinet approved the private participation in the Ratchaburi Power Plant in central Thailand, west of Bangkok.

To manage this project, the Ratchaburi Electricity Generating Holding Company Limited (RATCH) was established as a wholly-owned subsidiary of the Electricity Generating Authority of Thailand (EGAT). RATCH then formed a wholly-owned subsidiary, Ratchaburi Electricity Generating Company Limited, to own and operate the Ratchaburi Power Plant.

In March 2000, RATCH was officially established and listed on the Stock Exchange of Thailand in October of the same year. EGAT remains the single largest shareholder of RATCH, owning 45% of the company.

Since its inception, RATCH has grown into a leading energy and infrastructure company in Thailand, with an expanding presence in the Asia Pacific region. It has diversified its portfolio to include various energy sources, such as natural gas, coal, renewable energy, and waste-to-energy. RATCH is also involved in infrastructure projects, including toll roads and telecommunications.

In 2011 RATCH launched its subsidiary RATCH Australia through an initial acquisition of an 80% stake in the Transfield Services Infrastructure Fund, strategically positioning and strengthening itself in the Asia Pacific market, and reinforcing its position as a leading energy and infrastructure company.

This acquisition, later converted to 100% ownership of the relevant assets, laid the foundations for RAC’s subsequent growth and expansion in the country of our renewal energy assets, with the successful delivery of the Mt Emerald, Collinsville, Collector and Yandin projects.

RATCH acquired an 80% stake in the Transfield Services Infrastructure Fund (TSI Fund), effectively becoming the majority owner.

Board of Directors

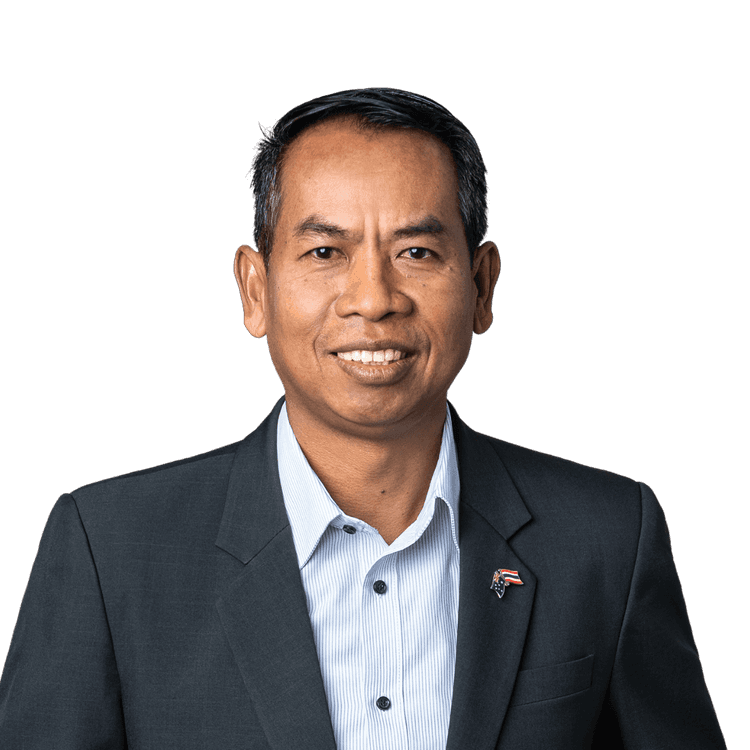

Nitus Voraphonpiput

Chairperson, CEO RATCH Group

Wadeerat Charoencoop

Chief Financial Officer, RATCH Group

Thana Boonyasirikul

Chief Asset Management Officer, RATCH Group

Nawapol Disathien

Executive Vice President - Corporate Administration, RATCH Group

Sahachthorn Putthong

CEO, RATCH Australia Corporation

Leadership Team

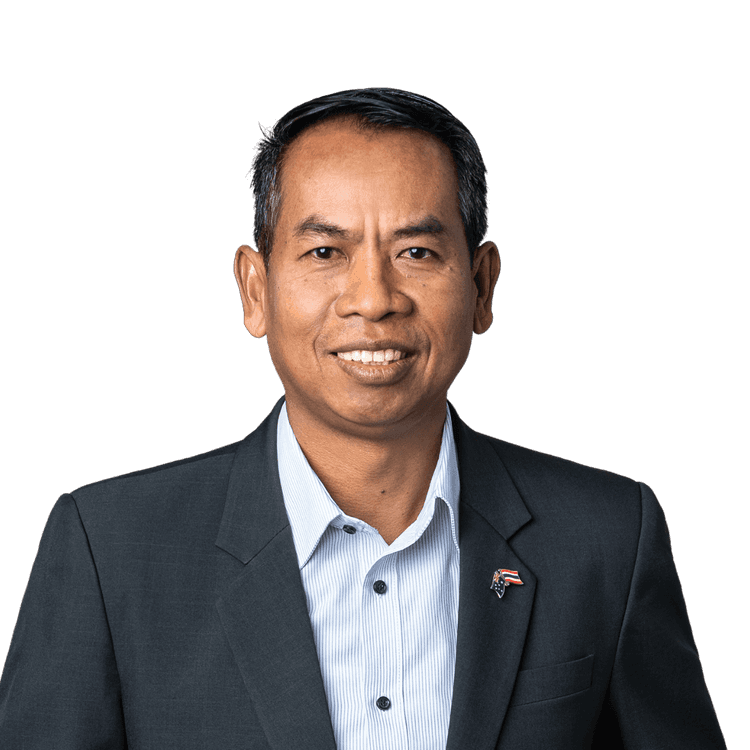

Sahachthorn Putthong

CEO, RATCH Australia Corporation

Simon Greenacre

Chief Legal Officer

James Lee

Chief Operating Officer

Greg Meredith

Chief Financial Officer

Hugh Sangster

Chief Business Development Officer

Neil Weston

Chief Project Development Officer